Mortgage calculator twice monthly payments

This isnt really true. Notice there is a big difference.

Bi Weekly Mortgage Calculator How Much Will You Save Mls Mortgage Mortgage Amortization Calculator Pay Off Mortgage Early Mortgage Payment Calculator

On my mortgage how does Chase decide if my money is for my monthly payment or an additional principal payment.

. It has many options that you may need such as PMI property tax home insurance monthly HOA fees and additional mortgage payment. The monthly vs biweekly mortgage calculator will find out how much faster you can pay off your mortgage with biweekly payments and how much you will save in interest payments. In addition to making extra payments another great way to save money is to lock-in historically low interest rates.

Some balloon mortgages calculate your monthly payments based on a 30-year amortizing mortgage then require you to make the balloon payment after 5 or 10 years. Round up your monthly payments to the next 100 and pay the difference. When the full payment due for the month has already been applied to your mortgage any extra money received that month will be applied as a principal payment.

Put simply its a standard mortgage calculator with extra payments built-in so its really easy to use. Mortgage payments rarely end in an even multiple of 100 and zero cents. A mortgage calculator helps prospective home loan borrowers figure out what their monthly mortgage payment will be.

According to the Mortgage Bankers Association the average size of new 30-year mortgages in the US. Meanwhile other lenders offer interest-only mortgages that allow borrowers to defer principal payments for the first several years. For instance a five-year auto loan might begin with 75 of your monthly payments focused on paying off interest and 25 paying toward the principal amount.

Bi-weekly means you pay every two weeks for a total of 26 payments a year. Semi-monthly means you pay twice a month for a total of 24 yearly payments. Lenders often roll property taxes into borrowers monthly mortgage bills.

In the above example if the borrower refinances the amount into a mortgage the entire 500000 deducting any down payment will be amortized into a 29-year mortgage. You dont pay down any principal in the early yearsonly interest. It can be a good option for those wanting to contribute more money toward a.

Before taking a fortnightly option be sure to arrange it with your lender first. Your mortgage payment includes your principal and interest down payment loan term homeowners insurance property taxes and HOA feesThis gives you the ability to compare a number of different home loan scenarios and how it will impact your budget. However the homeowner can achieve the same effect on a monthly plan by utilizing electronic bill payment or an automatic bank draft.

To calculate how long it will take for the mortgage holder to pay off the average mortgage set up the calculator this way. Using our amortization calculator we can calculate the monthly mortgage payment which will be 2150. Youre paying toward both principal and interest over a set period.

Banks use an automatic bank draft for bi-weekly plans which means all mortgage payments will be on time. While private lenders who offer conventional loans are usually not required to do that the FHA requires all of its borrowers to pay taxes along with their monthly mortgage payments. If your payment due for the month hasnt been received and applied yet well hold the money as.

When you have a mortgage at some point you may decide to try and pay it off early. Paying a mortgage twice per month will improve the homeowners credit. Mortgage Loan Auto Loan Interest Payment.

To determine how much property tax you pay each month lenders. Fortnightly payments follow the 52-week calendar year instead of the 12-month timetable. For instance if your current payment is 1527 per month you can pay 1600.

Smart digital tools like the mortgage rate estimator allow prospective homeowners to explore a variety of pricing and rate options run different scenarios and really get a grasp on potential costs and payments. Use our budget worksheet to calculate where you are spending your money. For example if youre interested in paying off your mortgage off in 15 years as opposed to 30 you generally need a monthly payment that is 15X your typical mortgage payment.

But also very powerful. One option to consider is a biweekly every two week payment plan. Is approaching 400000 and interest rates are hovering around 3.

A good monthly home mortgage calculator tells individuals not only if they can afford a selected home but what kind of factors might. A mortgage payment calculator takes into account factors including home price down payment loan term and loan interest rate in order to determine how much youll pay each month in total on your home loan. A 30-year fixed-rate.

A person could use the same spreadsheet to calculate weekly biweekly or monthly payments on a shorter duration personal or auto loan. 2020 has been a record year for mortgage originations as many homeowners refinanced to take advance of low. This way interest payments become available usually twice a year and owners receive the face value of the bond at maturity.

Sometimes called real estate taxes property taxes are typically billed twice annually. Some of Our Software Innovation Awards. Paying Taxes With a Mortgage.

Once you have a better idea of your current spending habits you can make adjustments to reach your financial goals. Free investment calculator to evaluate various investment situations considering starting and ending balance contributions return rate and investment length. Use this mortgage calculator to estimate how much house you can afford.

Redfins mortgage calculator estimates your monthly mortgage payment based on a number of factors. After the COVID-19 crisis the FOMC dropped the Fed Funds Rate to zero and issued forward guidance suggesting they would not lift rates through 2023. Since its founding in 2007 our website has been recognized by 10000s of other websites.

By default this calculator is selected for monthly payments and a 30-year loan term. It is 29 years because the first year was spent in construction. Because you make payments every 2 weeks this results in 26 half payments which is equivalent to 13 monthly mortgage payments.

Mortgage Amount or current balance. By rounding up to the next 100 and putting the difference towards principal youll end up paying less in interest. With biweekly mortgage payments you make 26 half-payments a year which equates to 13 total payments in a year.

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Biweekly Mortgage Calculator How Much Will You Save

How To Calculate Mortgage Payments In Excel

Extra Payment Mortgage Calculator For Excel

Downloadable Free Mortgage Calculator Tool

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

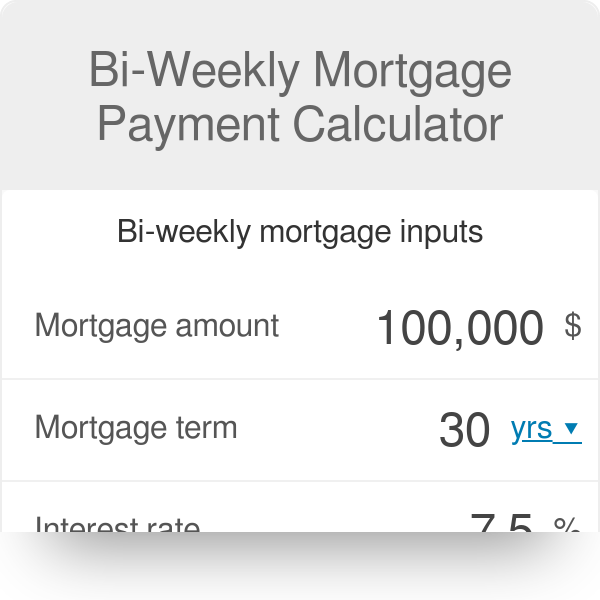

Bi Weekly Mortgage Payment Calculator

Mortgage Payoff Calculator With Extra Principal Payment Free Template

Bi Weekly Mortgage Calculator Extra Payment Amortization Table Mortgage Payoff Amortization Schedule Mortgage Payment Calculator

Biweekly Mortgage Calculator

Download Microsoft Excel Mortgage Calculator Spreadsheet Xlsx Excel Loan Amortization Schedule Template With Extra Payments

Bi Weekly Loan Calculator Biweekly Payment Savings Calculator

Biweekly Mortgage Calculator How Much Will You Save

Downloadable Free Mortgage Calculator Tool

Biweekly Mortgage Calculator How Much Will You Save